GameStop (GME) joins Bitcoin club - desperation move or clever use of cash?

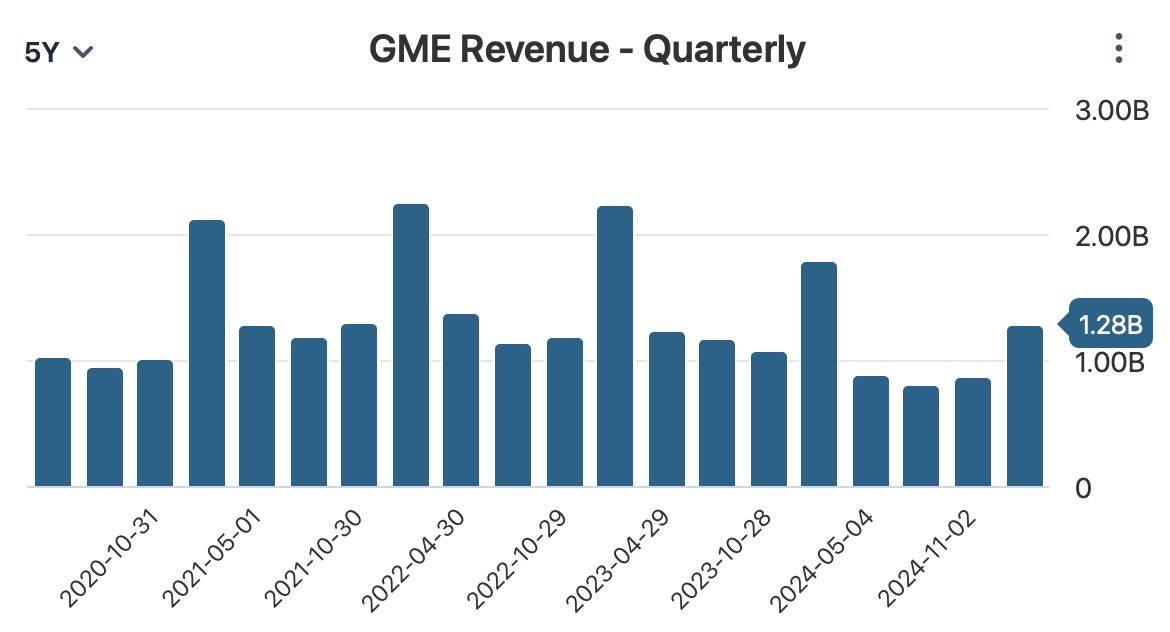

The video game retailer that became famous during the 2021 meme stock mania (GME and AMC) is now facing a peculiar problem. In the last few months, they’ve been sitting on a substantial cash pile—$5 billion, an amount that would bring a smile to C-tier management in comparably bigger companies. But it looks like GameStop is struggling to adapt its business model to the digital age. The biggest sign of that? Their latest Q4 results show a 28% YoY revenue drop.

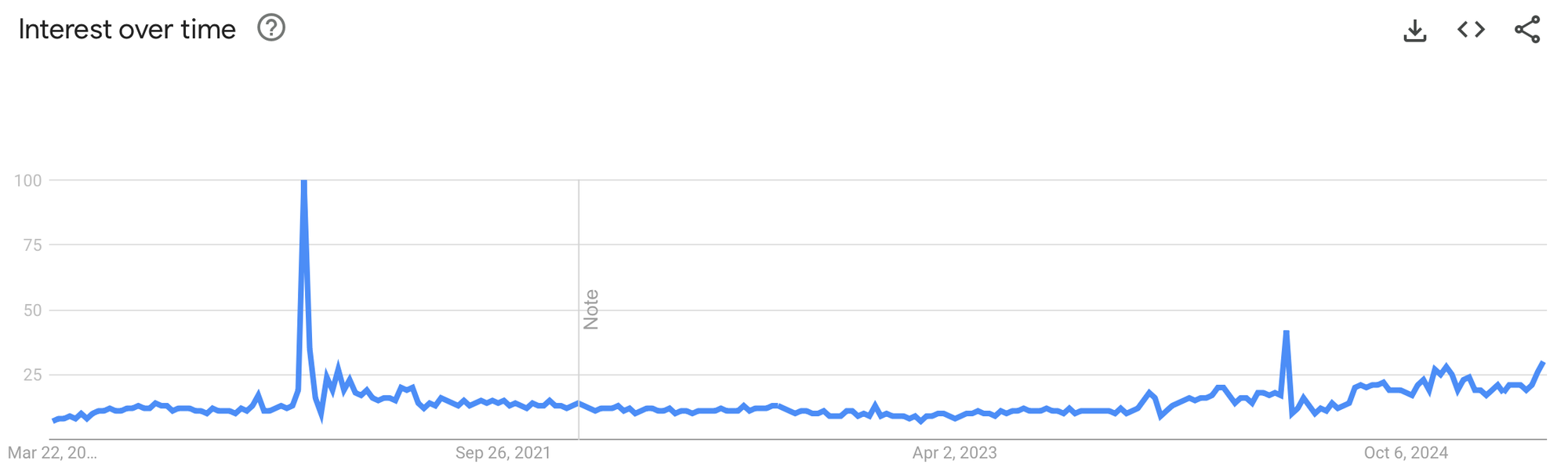

Here, we need to address how the company acquired that amount of cash reserves. To keep it short, GME capitalized on its meme stock status, mainly during periods of heightened retail investor enthusiasm, which surged multiple times over the last five years. On several of these occasions, the company issued a significant number of shares at premium prices. In the last two years alone, they offered 140 million shares, raising around $3.4 billion in total.

Beyond stock sales, GameStop improved its liquidity by slashing costs and paying almost all of its debt. This left company with minimal liabilities and very beautiful balance sheet.

No Clear Plan, Just Hype? The Bitcoin Play Raises Questions

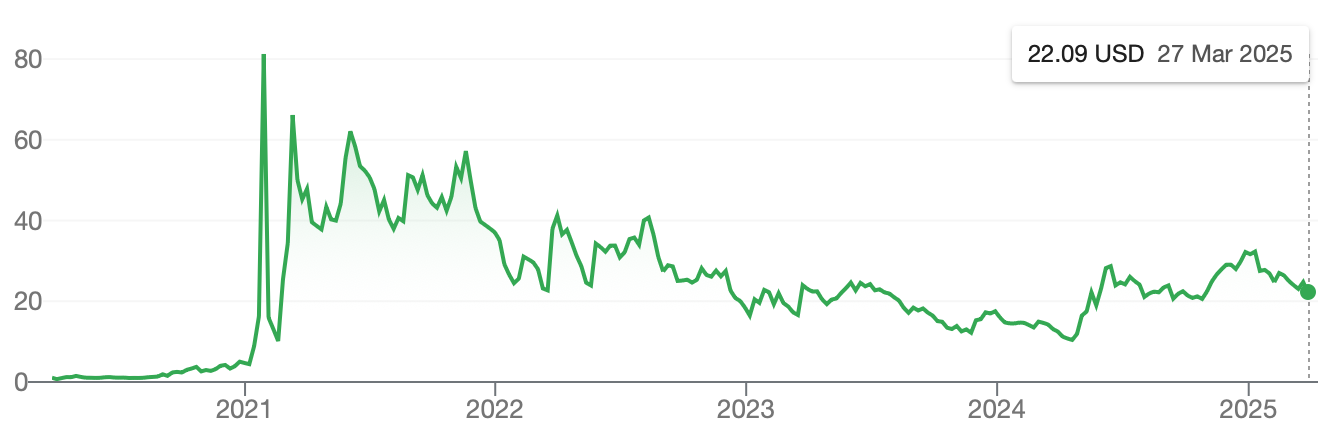

On March 25, 2025, GameStop announced that its board had unanimously approved adding Bitcoin as a treasury reserve asset, a move that sent its stock surging over 6% in after-hours trading (more on this later). This decision aligns GameStop with companies like MicroStrategy (now known as Strategy), which has aggressively invested in Bitcoin. CEO Ryan Cohen appears to be following a similar playbook.

At the time of writing, the company still hasn’t explained how much Bitcoin it plans to buy. This is why I see this as a desperate move—it signals that GME is in a stage of uncertainty. There’s a noticeable lack of significant acquisitions or gaming innovations that could put their cash to better use. While Bitcoin could serve as a hedge against inflation or a speculative investment, without a clear vision for its core business, it risks becoming nothing more than a flashy distraction.

Additionally, holding a significant amount of Bitcoin (or any other cryptocurrency) makes GameStop more volatile, as the price change of these assets will directly impact the company’s market capitalization.

GameStop Needs a Real Strategy—Not a Bitcoin Side Hustle

To sum it up, the stock market is currently going through a correction phase, and as expected, the 6% price increase mentioned earlier didn’t hold for long. What I’d like to see is the CEO presenting a real strategy for how to use the company’s cash. Without that, all the positive developments from before won’t make much of a difference in the end.

Becoming a shell company for Bitcoin investors should never be the goal. After all, if the plan is simply to buy Bitcoin, why not just purchase it directly? There’s no real need for another company acting as a middleman in this space.