Google Earnings Review Q3 2024

As anticipated in previous post, this week has been full of surprises, particularly in the tech sector. Several of the world's largest tech companies have released their financial reports, and most have exceeded expectations.

One company that has garnered significant attention recently is Alphabet, the parent company of YouTube, Google, Google Cloud, and many others. The company reported a 15% year-over-year revenue increase to $88.3 billion, demonstrating strong momentum across all its businesses. Notably, Google Cloud revenues surged 35% to $11.4 billion. We'll delve deeper into this later.

Total operating income increased to $28.521 billion (up 34% quarter-over-quarter), resulting in an operating margin of 32% (compared to 28% in Q3 2023). Earnings per share (EPS) rose 37% to $2.12, surpassing analysts' estimates of $1.84 by 14%.

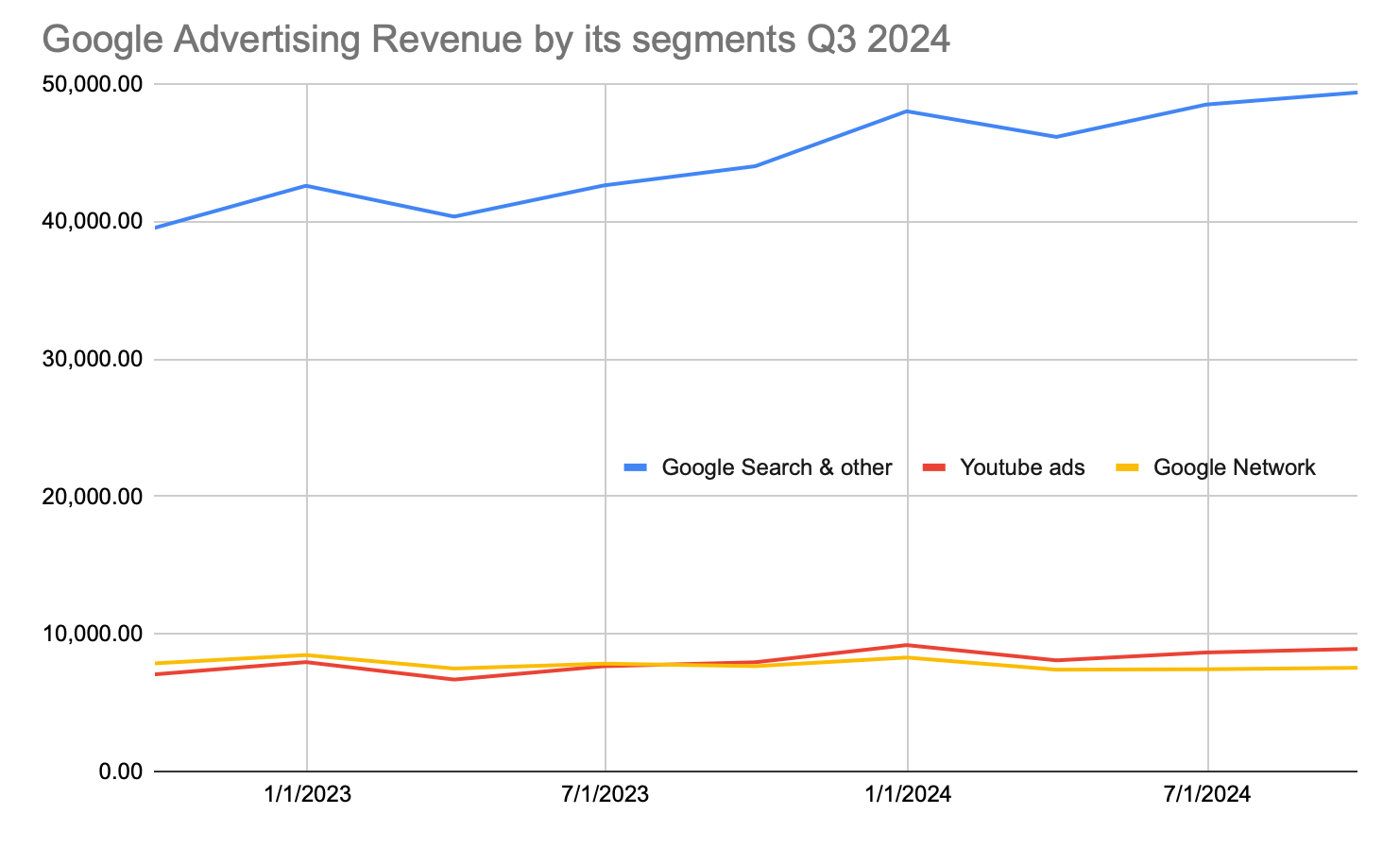

Google Advertising

The largest part of Alphabet’s business is its advertising segment, which comprises Google Search, YouTube ads, and Google Network. While this segment didn’t produce any major surprises, Google Search remains a key driver of Alphabet’s success and continues to perform exceptionally well.

It’s also intriguing to observe YouTube’s consistent revenue growth quarter after quarter. It seems that Alphabet has finally cracked the code for effective advertising on this platform.

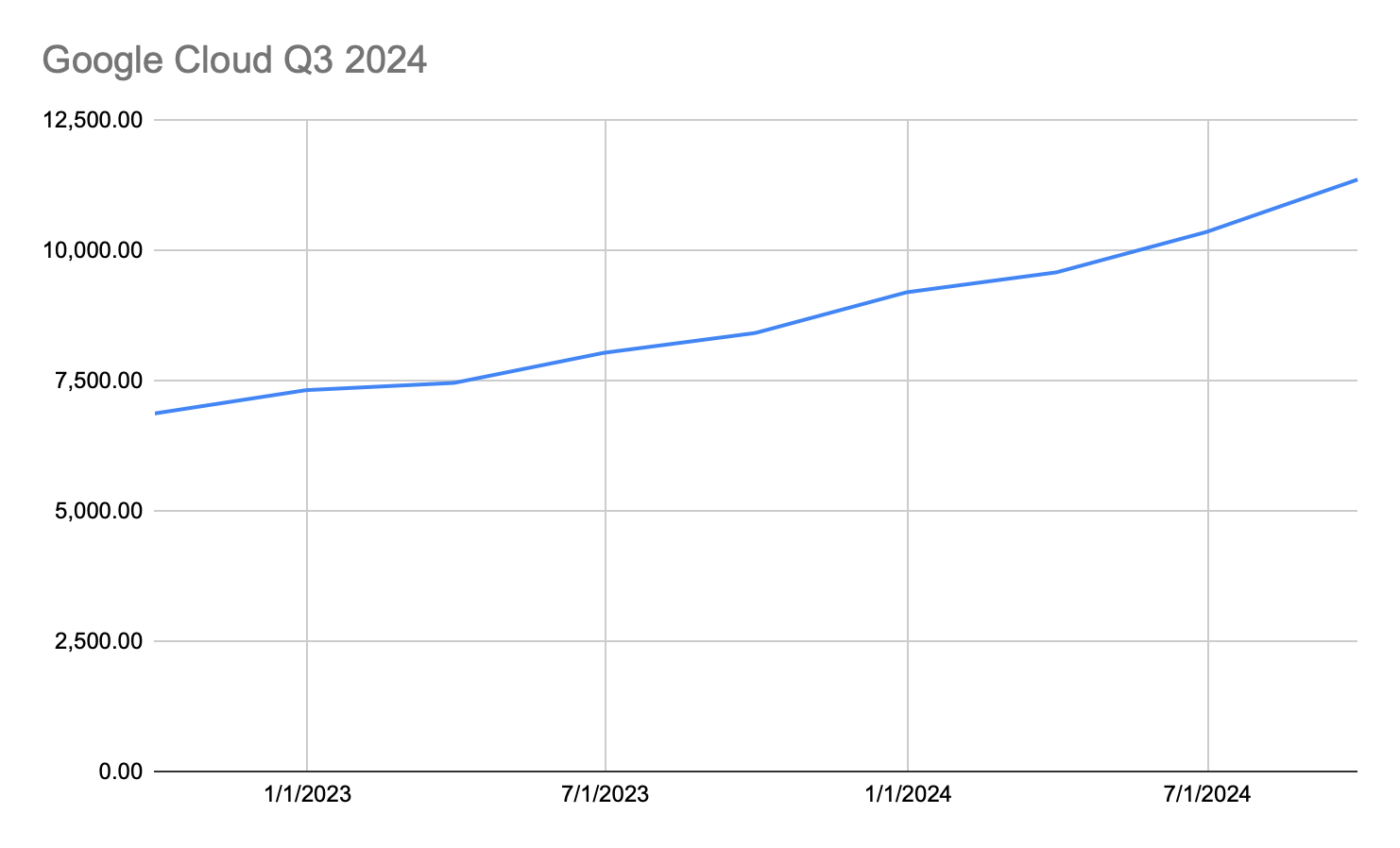

Google Cloud

Finally, we arrive at the part of the report that investors have been eagerly awaiting. As previously mentioned, Google Cloud revenues surged 35% to $11.4 billion, and the segment is now generating an operating income of $266 million. After struggling to turn a profit with its cloud business for a long time, Google seems to have finally found its footing.

It's worth noting that Amazon Web Services (AWS) experienced a year-over-year increase of approximately 19%. While this may seem like a significant win for Alphabet, it's important to remember that AWS is still a much larger and more established player in the cloud market. AWS's operating income and revenue are considerably higher, but we'll delve deeper into this comparison in future posts.

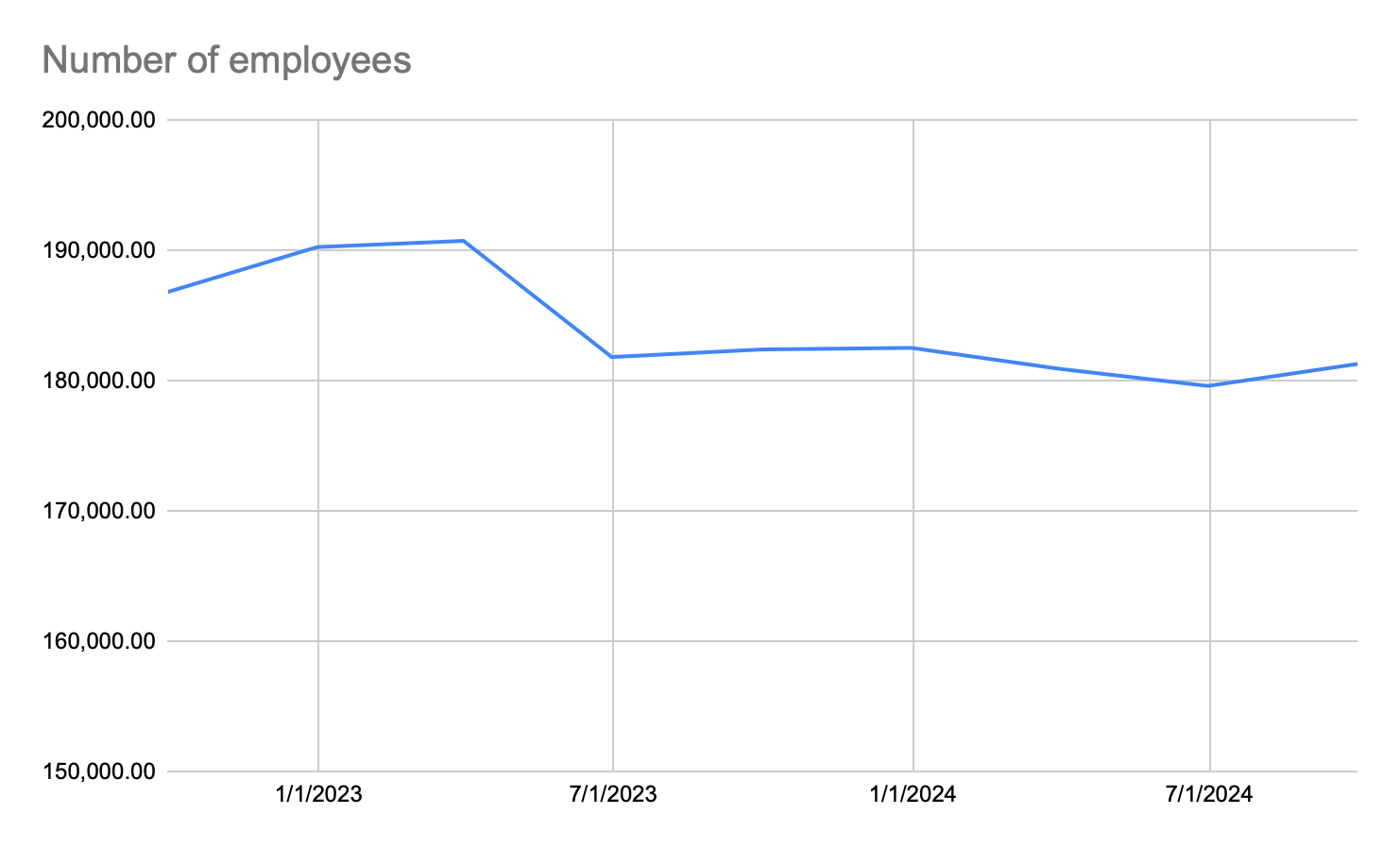

R&D and Number of employees

It's encouraging to see companies investing in their future growth. This report reveals that Alphabet increased its Research and Development (R&D) spending by approximately 9% year-over-year, bringing the total R&D expenditure to around $36 billion. Coupled with an increase in employee numbers after several quarters of decline, this suggests that the recent wave of layoffs in the tech industry may be subsiding. We'll need to monitor this trend closely in the next quarter to confirm.

As investors, we're excited to see what the future holds for Alphabet. With the upcoming US presidential election, it's challenging to make definitive price predictions. However, given the company's strong performance,I'm optimistic about its future.